Creating pay stubs quickly is indeed a challenging task for every business owner. To confirm the company’s income and transparent financial reporting to the tax office, it is essential to consider many subtleties and features. The payment receipt generator is the most straightforward and modern tool that helps create all the necessary documents as quickly as possible to carry out calculations by the established standard norms.

Choosing the right paystubs generator Real Check Stubs is a complex process that requires maximum attention. Studying the available options in today’s market is necessary to optimize all costs and efforts. You can create a payment receipt right now to solve the tasks set using special online services for these tasks.

Table of Contents

Paystubs generator for generation of receipts

A pay slip is an important reporting tool to provide complete information about an employee’s payroll. This document describes the primary income for the reporting period, commissions, tax deductions, and other contributions to the relevant funds. As a rule, providing such a receipt is only sometimes required, but keeping records for enterprises is mandatory. Usually, these tasks are handled by an authorized employee at the enterprise. But the company can only sometimes afford to hire such a specialist. For this reason, it is advisable to use a unique automation tool called a payment receipt generator.

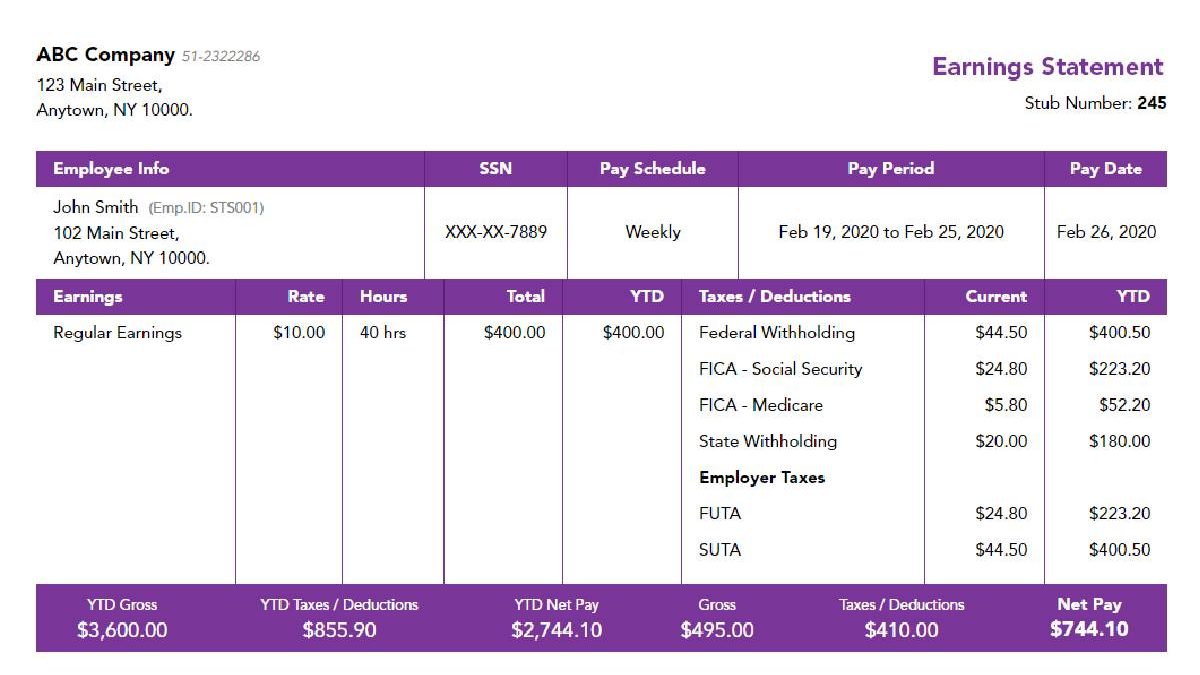

The payment receipt confirms the stability and completeness of the employee’s salary. Also, it indicates that the employer provides all payment information promptly and fully fulfills its obligations to employees and the state by established standards. Using the generator of payment receipts, you can describe the following basic information:

- the amount of time worked by an employee in the process of performing daily activities;

- the total salary level of the employee before the calculation of taxes from the salary;

- various taxes that are levied from the salary of an employee;

- other payments and net pay for the work done.

This information must be displayed in the document. Using a unique template with the help of a generator of payment receipts, it will be possible to fully automate the entire process of working with documentation following the established business needs. Properly prepared documents guarantee the safety of employees and the transparency of the company’s work.

Who uses pay stubs?

The payment receipt generator is a versatile tool with a wide range of functionality. It is usually used in such cases:

- Using the generator, employers can generate pay stubs for tax deductions and wages for their employees. The entire amount of payments should indicate as accurately as possible to reflect the transparency of personal data.

- Employees can use pay stubs to verify formal employment and income. Also, with the help of a receipt, you can confirm the payment of taxes and other fees following the established standard norms.

- Independent performers must verify their income and taxes using a pay stub generator. Such a tool is much simpler and more efficient and allows you to automate many processes and tasks for an employee.

- Self-employed people often use pay stub generators to verify their income levels and show that they have paid taxes. With the help of the generator of payment receipts, you can create a tax return that fully complies with all established standard norms, confirming the payments made.

Verifying income with a pay stub may be required in many situations. For example, this document provides information for obtaining a loan, renting a home. Applying for a business loan, and getting an official visa. It is essential to correctly use all available tools to implement tasks of any complexity.

What do you need to know about using the pay stub generator?

The pay slip generator is an adequate payment tool that allows you to optimize the accounting of income and expenses and better understand tax deductions and other features.

Among the main characteristics of the tool are the following:

- With the help of a receipt, wages for a certain period are consider. An employee can get information about what income he receives if he needs to confirm the profitability in a particular case.

- With the help of the generator of payment receipts, it is possible to compensate for potential costs and expenses in the process, consider possible deductions and calculate wages in the most relaxed mode.

- Salary often depends on many parameters, and the generator of pay slips makes it easy to consider all the leading indicators, the number of hours worked, and tasks completed for a set period, which helps to reduce possible costs.

- Using the generator, you can create a payment schedule in such a way as to display the information as accurately as possible. To do this, you can set the appropriate templates using the software.

The pay stub generator helps you avoid common mistakes and minimizes possible costs by reducing the risk of errors and potential fraud by managers or other employees. Payment receipts compiled using automation tools fully comply with standard norms and requirements, making them relatively simple and understandable.

As a rule, a standard pay stub can take into account such primary data:

- information about the official employer;

- information about the employee who works under an employment contract;

- selected payment cycle – usually here indicates the main periods of accrual of specific payments by established standard norms and requirements;

- payroll calculation – calculations are carried out based on all receive data using the rate data;

- the number of hours worked – this parameter determines the working efficiency of employees and makes the process of payroll accounting transparent with the help of special payment tools;

- tax withholding makes it possible to display the tax deductions that employees must pay in the course of their daily activities;

- retention in favor of specific funds fully reflects certain parameters and tasks.

Each indicator is essential in payroll and is consider when using the pay stub generator. Which allows you to choose the best solution for business needs.

Using a trusted paystubs generator

Choosing the right pay stub maker is an easy and reliable way to keep your business transparent. The process of preparing the documentation is as simple as possible. All calculations are carry out in real-time, which allows you to implement even the most complex operations.

An intuitive service allows the business to develop and focus on essential tasks without wasting time on organizational and third-party issues. You do not need to contact experts or third-party contractors to calculate employees’ salaries.